Indicators on VA Loans - Eligibility, Benefits & How to Apply - Zillow You Should Know

VA Loans: Apply For a VA Home Loan Here - Navy Federal Fundamentals Explained

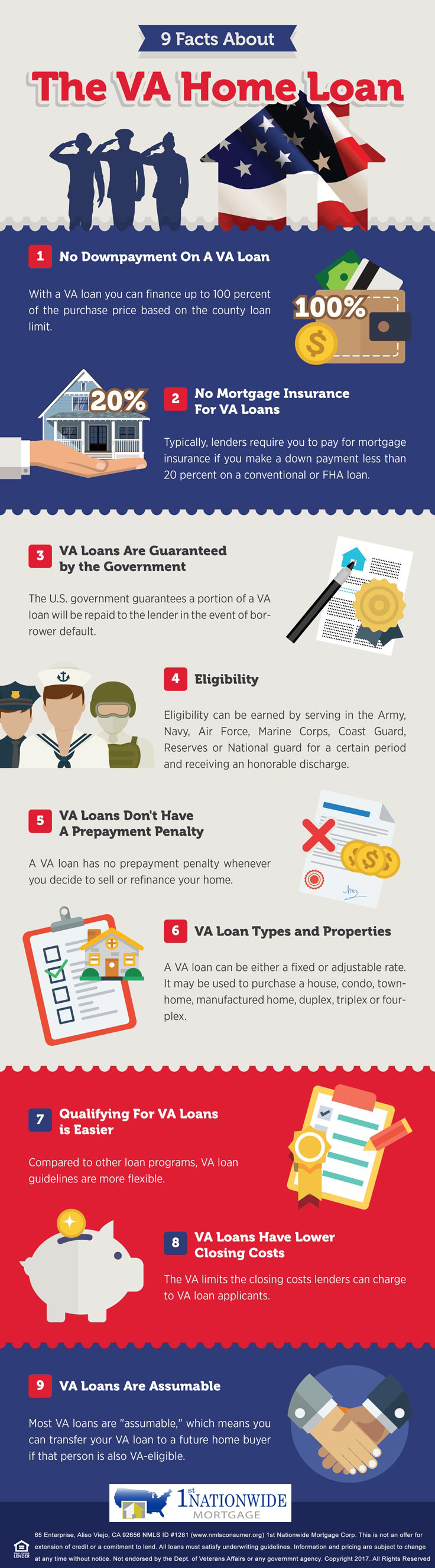

Your lender might have particular requirements for a no-down-payment VA loan. For example, they might need that you have a greater credit history if you're putting down less than 10%. The requirement to purchase a home with a VA loan through Rocket Home loan without any down payment is still a mean of 580.

Here's a glance at simply a few of them: Financing Charge Many people who get a VA loan are required to pay a funding cost, which covers the cost to taxpayers. The VA funding cost ranges from 2. 3 3. 6% of your loan quantity. The cost of the fee is figured out by your type of service, the size of your down payment, whether it's the newbie you're getting a VA loan and whether you're purchasing or re-financing the property.

Eight Essential Tips to Help You Land a VA Loan - Military.com

Don't fret, however. In a lot of cases, if you do not have the money up front, the VA funding fee can be rolled into your home mortgage. Reserve Funds A lot of loans need you to have additional deposit that you're not using for upfront expenses. This guarantees that you'll have the ability to pay as soon as your loan closes.

Everything about VA Home Loan Rates and Requirements - UHM

Although it's not constantly needed, it's a good idea to show reserves equal to 2 months' worth of home loan payments.

About Home Loans VA assists Servicemembers, Veterans, and qualified enduring partners become property owners. As part of our objective to serve you, we supply a mortgage warranty benefit and other housing-related programs to help you buy, develop, fix, keep, or adapt a home for your own individual tenancy. VA Home Loans are supplied by private lenders, such as banks and home loan business.

Using A VA Loan for Real Estate Investment - Military Benefits

Interested in buying a house? Before you buy, be sure to read the. Check Here For More can assist you under the homebuying procedure and how to make the many of your VA loan benefit. Download the Purchaser's Guide here. Main pillars of the VA mortgage benefit required (* Note: Lenders need downpayments for some borrowers using the VA mortgage guaranty, but VA does not need a downpayment) Competitively closing costs need for Private Home loan Insurance Coverage (PMI) The VA home loan is a: you can use the guaranty numerous times Benefits Assist you acquire a house at a competitive interest rate typically without requiring a downpayment or private mortgage insurance.